France has skilfully anchored into this dynamic terrain but the question really is: what does France need to do to tap into this area completely and become the capital markets’ centre for Islamic financing in the western world?

France has skilfully anchored into this dynamic terrain but the question really is: what does France need to do to tap into this area completely and become the capital markets’ centre for Islamic financing in the western world?

France has long been positioned as one of the vanguards of financial innovation and this has paved the way for changing the regulatory environment. For French organisations, this industry could represent a major source of liquidity and finance. The industry offers investors a means of achieving differentiation through diversification, helping them gain a foothold in new markets. In 2007, Christine Lagarde, the French minister of economy, asked the country’s parliament and treasury to assess and develop France’s infrastructure to attract Islamic finance.

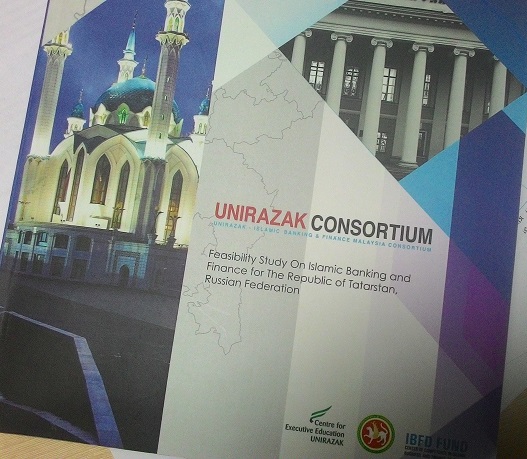

That year, Paris EUROPLACE, an organisation that promotes the French capital’s financial district, formed an Islamic finance committee to address the legal, fiscal and regulatory hindrances to the industry. Two years later, a sukuk (or Islamic bond) working group was created with lawyers, tax specialists, Sharia advisers and many French banks to develop a sukuk structure under French law.

France’s main objectives this year are to issue a sukuk in Paris under French law, translate the AAOIFI Sharia standards to French and issue the country’s first licence for an Islamic financial institution that is compliant under both national and European law.

Creating a regulatory environment friendly to the issuance of a licence would allow France to provide Sharia-compliant investment and commercial banking products denominated in foreign currencies to investors throughout Europe.

These aspirations are not far from reality considering France has unparalleled access to a broad investor base and a strong political will shared by all players across the French financial community.

The quality and liquidity of the French asset management market are key advantages to ensuring the success of sukuk issuances. Major French banks have also expanded Islamic finance offerings internationally with growing demand.

This demand, coupled with a local market of more than 5 million Muslims and access to high-net-worth Muslim investors globally, provides a healthy environment for the growth of Islamic finance.

A number of reforms have been adopted to advance Islamic finance in the country. In mid-2007, the French Financial Markets Authority (AMF) issued a recommendation for Sharia-compliant funds and a year later it published a statement approving the listing of sukuk in France.

Recently, Paris EUROPLACE signed an agreement with AAOIFI paving the way for greater co-operation to drive the development of Islamic finance in France.

This year, Qatar Islamic Bank signed a memorandum of understanding with Banque Populaire Caisse d’Epargne, France’s second largest banking group, to gain access to the French retail banking and small to medium-size business markets.

The Euronext Paris securities market soon followed, creating its own sukuk-listing segment. This not only guaranteed the reliability and security of Euronext’s market but it also supported issuers with experienced listing teams.

Early last year, France introduced tax status adjustments for Islamic finance contracts on murabaha (type of money-market instrument) and sukuk transactions.

This will promote co-operation between the two banks in France and try to build a lasting partnership.

The historical and political links between France and the Middle East give France the opportunity to hold a unique position in the Islamic finance industry.

Source: www.opalesque.com

Contacts |

Contacts |

Русский

Русский