THE first day of the Global Islamic Finance Forum (GIFF) was a Davos atmosphere, culminating in signing of the International Islamic Liquidity Management Corp (IILM) of eleven central banks and two supra-national organizations, and the bestowing of the Royal Award for Islamic Finance to Albaraka’s founder, Sh. Saleh Kamel.

An important takeaway from the GIFF event is Malaysia needs to think beyond the increasing cluttered space of Islamic finance hubs. The development of IILM corporation implies leading, without cheerleading, the transaction side of Islamic finance, as Islamic finance 2.0 is more about liquidity and less about listings, be it sukuk or syariah-compliant companies.

Lets put the transaction concept into prospective: Where is FX capital? London. Where is the equities capital? New York. Where is the bond capital? US/EU. Now, where is the Islamic finance transaction capital? London, with many listed sukuk, several Islamic ETFs and ETCs, five FSA approved Islamic banks, etc, seems to be an early answer, but the jury is out and still deliberating.

OIC Exchange

One of the earliest visions in Islamic finance, beyond the false dawn of an Islamic economy, is the establishment of an Islamic stock exchange. We hear that 88 per cent of stocks listed on Bursa Malaysia are syariah compliant (as at May 2010) and Dubai Financial Market became an Islamic stock exchange few years, yet the pursuit of a true Islamic stock exchange continues, but is that aligned to today’s market environment?

If the 57 Muslim countries in the Organization of the Islamic Conference (OIC) cannot (yet) establish a straight forward OIC equity index or Gulf Cooperation Council (GCC) stock exchange, held hostage to politics and regulations, the chance for an Islamic stock exchange seems remote. We need to think about disintermediating Islamic finance from the charged environment of politics and of OIC regulatory hurdles; be they local, regional or global.

The need of the hour is a global and neutral Islamic finance transaction platform entailing pre-trade, trade and post-trade multi-asset workflow. It is about populating the platform with all Islamic finance players, products, and prices and news in real time. Its about ‘conventional display’ of Islamic finance information.

The market place will be the final arbiter, by way of liquidity, on syariah compliance and standards for the particular time period. The stakeholders of Islamic finance have not given the marketplace, the opportunity to chime in on standardization.

The objective is to move from the present bilateral price discovery and liquidity to multiple price discovery and liquidity. Market liquidity is always moving towards efficiency, hence, today, trading platforms are taking order flow away from stock exchanges. Now, why continue to prioritize the pursuit of an Islamic stock exchange?

Bursa Malaysia

A commonly heard statement about listed companies on Bursa is ‘… 88 per cent of the companies listed on the exchange are syariah compliant and they account for 64 per cent % of the market’s capitalization.’ While impressive, has it resulted in portfolio investing from syariah-compliant investors in the GCC? Simply, no.

There may be a number of reasons, from Malaysia’s syariah screening being perceived as too liberal, to the illiquidity of many companies, to not understanding them, to the currency risk, but lets position Malaysia another way. The Securities Commission (SC) screens have traditionally been applied to Bursa listed companies, why not apply it outside of Malaysia to GCC and other universes for syariah compliance. See Table 1.

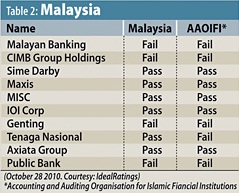

In addition, why not apply, say, Dow Jones Islamic Index rule book on screening to Malaysia. In both cases, applying Securities Commission SC screens outside Malaysia and ‘conservative’ screening rule books to Malaysia, we may be removing the reason not to invest in Malaysia, i.e., the screening is too liberal. See Table 2.

The new world order is about enlightened stakeholders of Islamic finance, from regulators to central banks to industry organizations, scholars and banks, moving away from yesterday’s country centric approach to an international approach.

The eventual objective of Islamic finance is to establish international standards, and these standards not only build intra-OIC bridges, but also to the G20/OECD countries.

The take away message for those wanting to expand their source of funding is the GCC petro-liquidity isn’t the only Islamic financing game in town, there is also the option of tapping the capital market liquidity in Malaysia.

Source: www.btimes.com

Contacts |

Contacts |

Русский

Русский